(Extracted from Annual Report 2024)

The Company is governed by a Board of Directors, which has responsibility for strategic leadership and control of the Group designed to maximise shareholder value, while taking due account of the interests of those with whom the Group does business and others.

Responsibility for achieving the Company’s objectives and running the business on a day-to-day basis is delegated to management. The Board exercises a number of reserved powers which include:

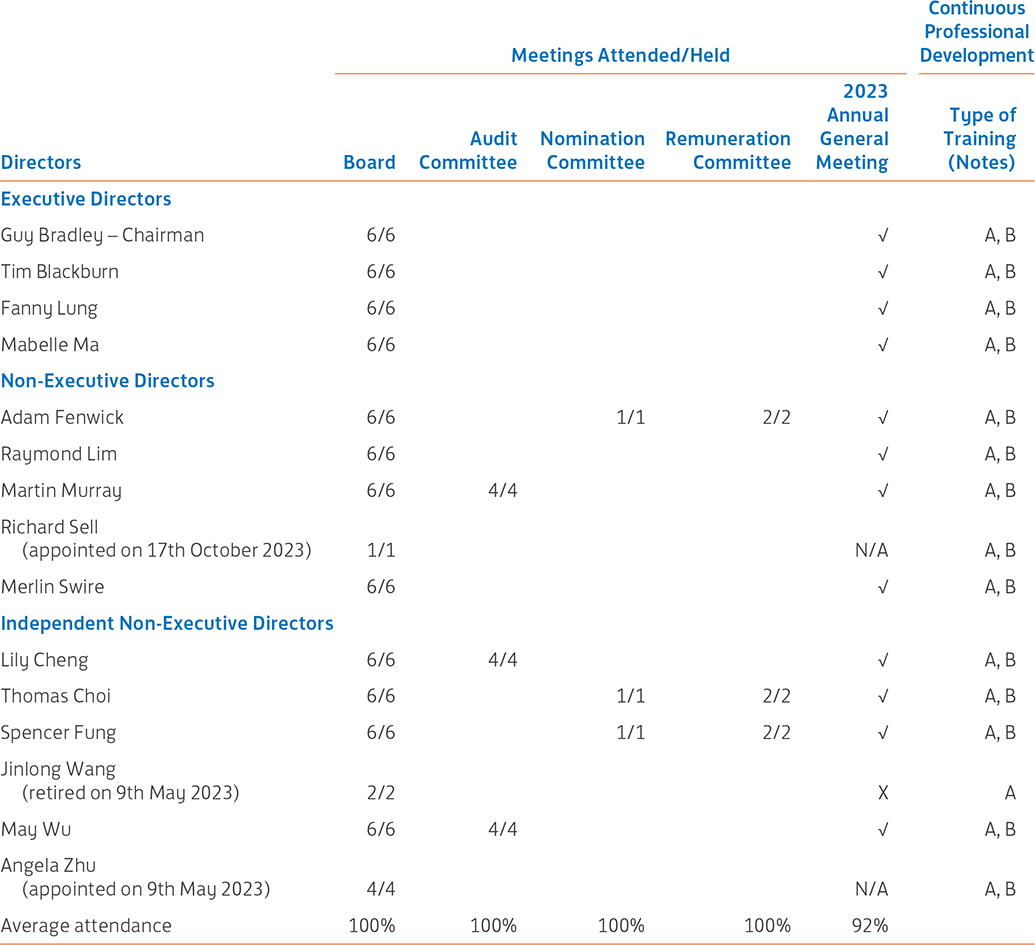

To assist it in fulfilling its duties, the Board has three primary committees, the Audit Committee (see pages 105 to 106), and the Nomination Committee (see pages 102 to 103) the Remuneration Committee (see page 103).

The CG Code requires that the roles of Chairman and Chief Executive be separate and not performed by the same individual to ensure there is a clear division of responsibilities between the running of the Board and the executives who run the business.

Guy Bradley, the Chairman, is responsible for:

Tim Blackburn, the Chief Executive, is responsible for implementing the policies and strategies set by the Board in order to ensure the successful day-to-day management of the Group’s business.

Throughout the year, there was a clear division of responsibilities between the Chairman and the Chief Executive.

The Board is structured with a view to ensuring it is of a high calibre and has a balance of skills, experience and diversity of perspectives appropriate to the Company’s business so that it works effectively as a team, and that individuals or groups do not dominate any decision-making.

The Board comprises the Chairman, three other Executive Directors and ten Non-Executive Directors. Their biographical details are set out in the section of this annual report headed Directors and Officers and are posted on the Company's website.

Tim Blackburn, Guy Bradley, Fanny Lung, Mabelle Ma, Martin Murray and Richard Sell are directors and/or employees of the John Swire & Sons Limited (“Swire”) group. Adam Fenwick and Merlin Swire are shareholders, directors and/or employees of and Raymond Lim is an adviser to the Swire group.

The Non-Executive Directors bring independent advice, judgement and, through constructive challenge, scrutiny of executives and review of performance and risks. The Audit, Nomination and Remuneration Committees of the Board comprise only Non-Executive Directors.

Five of the ten Non-Executive Directors are Independent Non-Executive Directors, which represents at least one-third of the Board of Directors.

The Independent Non-Executive Directors:

The Company has in place effective mechanisms to ensure that independent views and input are available to the Board. The Nomination Committee, a majority of which is comprised of Independent Non-Executive Directors, assesses the suitability and independence of potential candidates to be appointed as Independent Non-Executive Directors and reviews the independence of each Independent Non-Executive Director annually. The Independent Non-Executive Directors meet with the Chairman at least once annually without the presence of other Directors and they can interact with management and other Directors including the Chairman through formal and informal means. Independent professional advice is also available to all Directors whenever necessary. A review of these mechanisms is conducted on an annual basis to ensure their effectiveness.

Confirmation has been received from all Independent Non-Executive Directors that they are independent as regards the factors set out in Rule 3.13 of the Listing Rules. None of them holds cross-directorships or hassignificant links with other Directors through involvements in other companies or bodies. The Board considers that all of the Independent Non-Executive Directors are independent in character and judgement.

Spencer Fung has served as an Independent Non-Executive Director for more than nine years. The Directors are of the opinion that he remains independent, notwithstanding his length of tenure. Spencer Fung continues to demonstrate the attributes of an Independent Non-Executive Director noted above and there is no evidence that his tenure has had any impact on his independence. During his tenure, Spencer Fung was not involved in the daily management of the Company nor in any relationship or circumstances which would materially interfere with his exercise of independent judgement. He has not held any interests in the shares of the Company. He has demonstrated strong independence by providing impartial views and exercising independent judgment at Board and Board committee meetings. Drawing upon experience and skills acquired through his other directorships and offices, he is also capable of bringing fresh and objective perspectives to the Board. The Board believes that his detailed knowledge of the Company’s business and his external experience continue to be of significant benefit to the Company, and that he maintains an independent view of its affairs.

Taking into account all of the circumstances described in this section, the Company considers all of the Independent Non-Executive Directors to be independent as regards the factors set out in Rule 3.13 of the Listing Rules.

On appointment, the Directors receive information about the Group including:

Directors update their skills, knowledge and understanding of the Company’s businesses through their participation at meetings of the Board and its committees and through regular meetings with management at the head office and in the divisions. Directors are regularly updated by the Company Secretary on their legal and other duties as Directors of a listed company.

Through the Company Secretary, Directors are able to obtain appropriate professional training and advice.

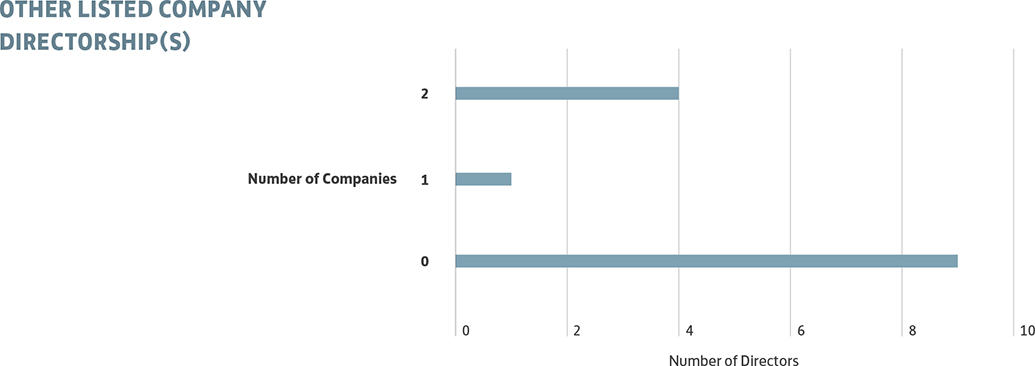

Each Director ensures that he/she can give sufficient time and attention to the affairs of the Group. All Directors disclose to the Board on their first appointment their interests as a Director or otherwise in other companies or organisations and such declarations of interests are updated regularly. No Director was a director of more than four listed companies (including the Company) at 31st December 2024.

Details of Directors’ other appointments are shown in their biographies in the section of this annual report headed Directors and Officers.

All committees of the Board follow the same processes as the full Board.

The dates of the 2024 Board meetings were determined in 2023 and any amendments to this schedule were notified to Directors at least 14 days before regular meetings. Appropriate arrangements are in place to allow Directors to include items in the agenda for regular Board meetings.

Agendas and accompanying Board papers are circulated with sufficient time to allow the Directors to prepare before meetings.

The Chairman takes the lead to ensure that the Board acts in the best interests of the Company, that there is effective communication with the shareholders and that their views are communicated to the Board as a whole.

Board decisions are made by vote at Board meetings and supplemented by the circulation of written resolutions between Board meetings.

Minutes of Board meetings are taken by the Company Secretary and, together with any supporting papers, are made available to all Directors. The minutes record the matters considered by the Board, the decisions reached, and any concerns raised or dissenting views expressed by Directors. Draft and final versions of the minutes are sent to all Directors for their comment and records respectively.

Board meetings are structured so as to encourage open discussion, frank debate and active participation by Directors in meetings.

Directors meet at least once annually to discuss the Company’s strategy, including investment and divestment plans and other strategic initiatives. The strategy session also serves as a platform for raising new initiatives and ideas.

The Board is provided with such information and explanations as are necessary to enable Directors to make an informed assessment of the financial and other information put before the Board. Queries raised by Directors are answered fully and promptly.

When necessary, the Independent Non-Executive Directors meet privately to discuss matters which are their specific responsibility.

The Chairman meets at least annually with the Independent Non-Executive Directors without the presence of other Directors.

The Board met six times in 2024, including a strategy session. The attendance of individual Directors at meetings of the Board and its committees is set out in the table below. Average attendance at Board meetings was 99%. All Directors attended Board meetings in person or through electronic means of communication during the year.

Notes:

A: Received training materials about matters relevant to their duties as Directors including on ESG.

B: Attended training by external advisers about applicable laws and regulations and topics pertinent to the business of the Company.

Key areas of activities of the Board during the year are summarised below.

The Company makes available continuous professional development for all Directors at the expense of the Company so as to develop and refresh their knowledge and skills.

All Directors have been provided with “A Guide on Directors’ Duties” issued by the Companies Registry, “Guidelines for Directors” issued by the Hong Kong Institute of Directors and “Corporate Governance Guide for Boards and Directors” issued by The Stock Exchange of Hong Kong Limited and other training materials on various topics, including ESG matters and regulatory updates issued by The Stock Exchange of Hong Kong Limited or external advisers. They were invited to attend seminars and conferences about financial, commercial, economic, risk management, legal, regulatory and other business matters.

The Company has arranged appropriate insurance cover in respect of potential legal actions against its Directors and Officers.

If a Director has a material conflict of interest in relation to a transaction or proposal to be considered by the Board, the individual is required to declare such interest and abstains from voting. The matter is considered at a Board meeting and voted on by Directors who have no material interest in the transaction.

Responsibility for delivering the Company’s strategies and objectives, as established by the Board, and responsibility for day-to-day management is delegated to the Chief Executive. The Chief Executive has been given clear guidelines and directions as to his powers and, in particular, the circumstances under which he should report back to, and obtain prior approval from, the Board before making commitments on behalf of the Company.

The Board monitors management’s performance against the achievement of financial and non-financial measures, the principal items monitored being:

The Company has adopted a code of conduct (the “Securities Code”) regarding securities transactions by Directors on terms no less exacting than the required standard set out in the Model Code for Securities Transactions by Directors of Listed Issuers (the “Model Code”) contained in Appendix C3 to the Listing Rules. These rules are available on the Company’s website.

A copy of the Securities Code has been sent to each Director of the Company and is sent to each Director twice annually, immediately before the two financial period ends, with a reminder that the Director cannot deal in the securities and derivatives of the Company during the blackout period before the Group’s interim and annual results have been published, and that all their dealings must be conducted in accordance with the Securities Code.

Under the Securities Code, Directors are required to notify the Chairman and receive a dated written acknowledgement before dealing in the securities and derivatives of the Company and, in the case of the Chairman himself, he must notify the Chairman of the Audit Committee and receive a dated written acknowledgement before any dealing.

On specific enquiries made, all the Directors of the Company have confirmed that they have complied with the required standard set out in the Model Code and the Securities Code.

Directors’ interests at 31st December 2024 in the shares of the Company and its associated corporations (within the meaning of Part XV of the Securities and Futures Ordinance) are set out in the section of this annual report headed Directors’ Report.

Potential new Directors are identified and considered by the Nomination Committee for appointment by the Board. A Director appointed by the Board is subject to election by shareholders at the first annual general meeting after his or her appointment, and all Directors are subject to re-election by shareholders every three years.

Potential new Board members are identified on the basis of skills, knowledge and experience which, on assessment by the Directors, will enable them to make a positive contribution to the diversity and performance of the Board. The Company reviews the composition of the Board on a continuing basis by keeping track of the tenure of Directors and the need for new Directors to be appointed and maintaining a pipeline of candidates comprising internal and external candidates as may be identified from time to time. Executive search agencies may be engaged as appropriate to identify external candidates with the desirable skillsets. The composition of the Board includes directors who are appointed as Independent Non-Executive Directors, nomination from substantial shareholder and executives of the Company.

In assessing the suitability of a proposed candidate (including Directors eligible for election or re-election), the following non-exhaustive list of factors will be considered:

During 2024, the Nomination Committee identified Yan Yan as a potential new candidate for directorship. On 4th March 2024, having regard to the qualifications and merits of the candidate and the benefits of diversity on the Board, the Nomination Committee nominated Yan Yan as an Independent Non-Executive Director. The Nomination Committee is satisfied with the independence of Yan Yan having regard to the criteria set out in the Listing Rules. On 22nd April 2024, the Board, having considered the recommendation of the Nomination Committee and having taken into account the skills, professional experience, cultural and educational background and diversity of perspectives that Yan Yan could bring and contribute to the Board, appointed her as an Independent Non-Executive Director with effect from the conclusion of the Company’s 2024 Annual General Meeting held on 7th May 2024.

On 4th March 2025, the Nomination Committee, having reviewed the Board’s composition and after taking into account the requirement that all Directors are subject to election or re-election (as the case may be) in accordance with the Company’s Articles of Association, nominated Guy Bradley, Tim Blackburn, Adam Fenwick, Spencer Fung, Mabelle Ma, Merlin Swire and Yan Yan for recommendation to shareholders for election or re-election at the 2025 Annual General Meeting. The nominations were made in accordance with objective criteria (including gender, age, cultural and educational background, ethnicity, professional experience, skills, knowledge, length of service, number of directorships of listed companies and the legitimate interests of the Company’s principal shareholders), with due regard for the benefits of diversity, as set out in the Board Diversity Policy. The Nomination Committee is satisfied with the independence of Spencer Fung and Yan Yan having regard to the criteria set out in the Listing Rules.

On 11th March 2025, the Board, having considered the recommendation of the Nomination Committee and having taken into account the respective contributions of Guy Bradley, Tim Blackburn, Adam Fenwick, Spencer Fung, Mabelle Ma, Merlin Swire and Yan Yan to the Board and their firm commitment to their roles, recommended all of them for election or re-election (as the case may be) at the 2025 Annual General Meeting.

The particulars of the Directors standing for election or re-election are set out in the section of this annual report headed Directors and Officers and will also be set out in the circular to shareholders to be distributed with this annual report and posted on the Company’s website.

Full details of changes in the Board during the year and to the date of this report are provided in the section of this annual report headed Directors’ Report.

The Board has adopted a Board Diversity Policy, which is available on the Company’s website. Responsibility for the implementation, monitoring and annual review of this policy has been delegated to the Nomination Committee.

The Board’s composition reflects a balance of skills, experience and diversity of perspectives among its members that are relevant to the Company’s strategy, governance and business and contributes to the Board’s effectiveness.

In order to achieve a diversity of perspectives among members of the Board, it is the policy of the Company to consider a number of factors when deciding on appointments to the Board and the continuation of those appointments. Such factors include gender, age, cultural and educational background, ethnicity, professional experience, skills, knowledge, length of service and the legitimate interests of the Company’s principal shareholders.

The Board is committed to maintaining an appropriate percentage of female Board members, which shall be not less than 30% at all times. The female representation on the Board at the date of this report is 36%.

The Company is also committed to maintaining a gender balance in the workforce with a target of keeping the female ratio at not less than 40% at all times. The female representation in the workforce at 31st December 2024 was 42.5%. Details of gender diversity in the workforce are disclosed in the section of this annual report headed Sustainability Review and in the Sustainability Report 2024 of the Company.

The Company has adopted the following measures to develop a pipeline of potential successors to the Board: